Manufacturers reported that output volumes were broadly unchanged in the three months to June, after rising for the first time in a year and a half in the quarter to May, according to the CBI’s latest Industrial Trends Survey (ITS). Manufacturers expect output to rise modestly in the three months to September.

Total order books improved in May, despite a sharp deterioration in the volume of export orders. Both total and export orders were reported below “normal” and below their long-run averages. Manufacturers reported that stocks of finished goods were more than adequate to meet expected demand, and to the same extent as last month. Meanwhile, expectations for selling price inflation picked up, with prices expected to rise at an above-average pace over the three months to September.

The survey, based on the responses of 248 manufacturers, found:

- Output volumes were broadly unchanged in the three months to June after rising in the quarter to May (weighted balance of +3%, from +14% in the three months to May) and were equivalent to the long-run average. Output is expected to rise modestly in the three months to September (+13%).

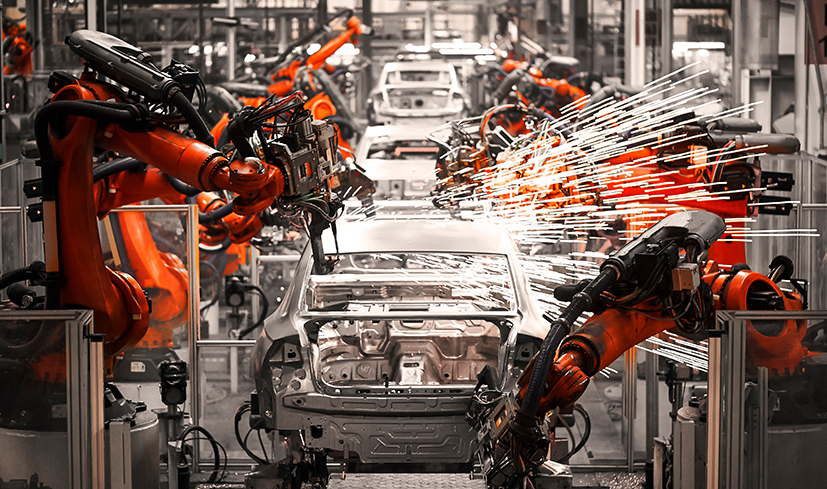

- Output increased in only 4 out of 17 sub-sectors, in the three months to June, with growth in the food, drink & tobacco, motor vehicle & transport sector, and plastics and furniture & upholstery sub-sectors broadly offset by falls elsewhere.

- Total order books were reported as below “normal” in June but improved sharply relative to last month (-18% from -33%). The level of order books remained slightly below the long-run average (-13%).

- Export order books were also seen as below normal and deteriorated relative to last month (-39% from -27%). This was also below the long-run average (-18%) and was the weakest outturn since February 2021.

- Expectations for average selling price inflation accelerated in June (+20%, from +15% in May) – well above the long-run average (+7%).

- Stock adequacy for finished goods were unchanged from June, with a net balance of manufacturers reporting that stocks were “more than adequate” standing at +14%, broadly in line with the long-run average.

Ben Jones, CBI Lead Economist, said: “We’ve seen a stop-start recovery in manufacturing output in recent months, with higher activity over the last quarter concentrated in a relatively small number of manufacturing sub-sectors.

“But it’s encouraging to see that manufacturers remain confident the economy is heading in the right direction and our June survey suggests that the recovery should broaden out over the summer.

“One note of caution is that order books remain soft. The sharp deterioration in export order books is particularly striking and is something to keep an eye on in the coming months.

“Whoever forms the government next week will be inheriting a challenging economic environment. They will need to have a credible plan to deliver sustainable growth. Now has to be the moment to focus on long-term solutions to tackle poor productivity and create an environment for business investment to accelerate.

“Top of the in-tray should be a cutting-edge trade and investment strategy, a Net Zero Investment Plan and more support for firms to invest in automation and AI. At the same time, a focus on building momentum behind the ‘big three’ enablers of tax, planning and skills policies within the first 100 days can give firms a clear flightpath for growth.”