Plans revealed for affordable homes and extra care scheme in Bridlington

Irwin Mitchell Asset Management acquires business of Leeds-based wealth manager

Adler and Allan acquire wastewater monitoring and management specialist Detectronic

Hippo Digital expands data and engineering capabilities with fellow Leeds firm

Water companies share in £1.6bn to improve water quality

- Yorkshire Water improving wastewater treatment infrastructure in Ilkley to improve the bathing water quality of the River Wharfe (£67 million)

- Anglian Water accelerating its regional storm overflow reduction plan in the east of England (£27 million)

- Severn Trent rolling out smart meters and modifying its Draycote Water reservoir in Warwickshire to increase water capacity (£70 million)

- Essex and Suffolk Water increasing water resilience in their area to better meet the needs of local customers including businesses (£18 million)

- United Utilities reducing around 8,400 spills per year, including reducing discharges into Lake Windermere (£800 million)

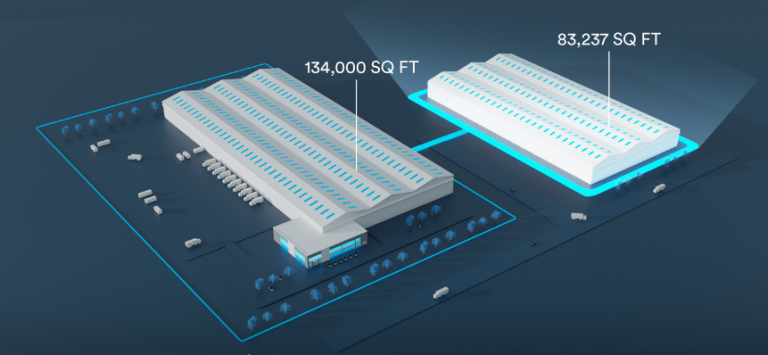

ITM Power signs 15-year lease on Bessemer Park extension plan premises

Loans to IT recycler create expansion and new jobs in Wetherby

Loans of £150,000 have allowed Wetherby-based IT recycling firm Zixtel Ltd to expand its recycling facilities, hire five new people and safeguard existing jobs.

The company, founded over 26 years ago, received the loans from Business Enterprise Fund and NPIF – BEF & FFE Microfinance, which is managed by the Business Enterprise Fund and FFE Microfinance, and part of the Northern Powerhouse Investment Fund. Specialists in IT recycling for businesses with redundant equipment, Zixtel expanded its services to include a recycling plant during the pandemic. With a mission to never send anything to landfill, Zixtel was dismantling all products by hand prior to the investment.Toni Cox, HR and compliance manager at the firm, said: “The loan has helped future proof Zixtel, given us the ability to hire five new people in our warehouse and recycling teams as well as safeguarding two jobs. Plus, the investment into new machinery will enable us to help other businesses with their environmental goals long-term.

“The new machines have helped us to improve efficiencies, allowing us to recycle more equipment faster. We can now easily separate materials such as precious metals and these then go on to be recycled further and re-introduced to the market lessening the need for mining of raw materials.”

According to research from Uswitch, the UK produces the second highest amount of e-waste per capita in the world, with IT and telecoms e-waste almost doubling in the UK between 2008 and 2022.

Mark Iley, investment manager at the Business Enterprise Fund, said: “It’s more imperative than ever that businesses do what they can to support the future of our planet – with Zixtel’s improved separating and recycling facilities, they’re offering companies peace of mind that their IT equipment can be recycled ethically and without sending anything to landfill.

“At BEF we’re committed to supporting businesses who are conscious about their own social impact, so providing the loan to Zixtel to enhance their recycling services and support their recruitment initiatives made perfect sense.”

Sean Hutchinson at the British Business Bank said: “Supporting innovative and sustainable businesses like Zixtel is at the heart of what the Northern Powerhouse Investment Fund is for. It’s businesses like this that are the driving force of the Northern business community – contributing to the nation’s net zero goals through its expertise in recycling, whilst supporting the local economy by creating jobs and expanding its facilities.”

The Northern Powerhouse Investment Fund project (NPIF) is supported financially by the European Union using funding from the European Regional Development Fund (ERDF) as part of the European Structural and Investment Funds Growth Programme 2014-2020 and the European Investment Bank.

UK Export Finance given an extra £10bn to support increased overseas sales

Drax invited to sit down with Government to discuss carbon capture project

Drax has been invited to talk to the Government immediately to move forward carbon capture project that the firm believes is the only one that canensure the Government is able to fulfil its restated commitment to achieving 5Mtpa of engineered Greenhouse Gas Removals by 2030.

Separately, the Government has stated that it will work closely with electricity generators currently using biomass to facilitate a transition to Power BECCS.

The Government has also confirmed that its response to the Power BECCS business model consultation, which took place in 2022, will be published imminently, providing further clarity on the delivery of BECCS as soon as possible.

Drax Group CEO Will Gardiner said: “Delivery of BECCS at Drax Power Station will help the UK achieve its net zero targets, create thousands of jobs across the north and help ensure the UK’s long-term energy security.

“We note confirmation that our project has met the Government’s deliverability criteria and Government remains committed to achieve 5Mtpa of engineered Greenhouse Gas Removals by 2030 – a goal that cannot be achieved without BECCS at Drax Power Station. We will immediately enter into formal discussions with Government to take our project forward.

“With the right engagement from Government and swift decision making, Drax stands ready to progress our £2bn investment programme and deliver this critical project for the UK by 2030.”

The Government recognises the important role which BECCS will play in delivering net zero and aims to deploy 5Mt of engineered CO2 removals per annum from BECCS and other engineered GGR technologies by 2030, rising to 23Mt in 2035 and up to 81Mt in 2050 to keep the UK on a pathway to meet its legislated climate targets, The Sixth Carbon Budget and net zero.

Drax Power Station is the UK’s largest single source of renewable electricity and BECCS is the only technology that can produce reliable renewable power, provide system support services and permanently remove CO2 at scale.