Cllr Michael Graham, Cabinet Member for Regeneration and Economic Growth, said: “It’s brilliant to see the market hall and the incredible work that has gone into transforming it, to give traders and shoppers the best facilities.

“We took the decision to invest in its future because an independent review we commissioned in 2018 found that, with some changes, the market could continue to be sustainable. “Markets play a significant role in bringing shoppers to the town centres and they contribute to our aim of growing the local economy and providing employment opportunities to residents.” Pontefract market has been renovated both inside and outside with new flooring, wiring, lighting, ceilings, and shutters. Repairs have been made to the roof to make it waterproof. The walls, ceilings and frames have also been redecorated to give the market a fresh look. Outside, feature lighting has also been installed to highlight the Grade II listed market facade, that was designed by Joseph Wilson and opened in 1860 by former Prime Minister, Lord Palmerston. Local ward councillors have also funded repairs to the traditional red telephones boxes. Pontefract is the second of the four markets to be completed. Work on Normanton finished in May. Of the remaining two, Castleford will complete in Spring 2024 and work on South Elmsall will start around this time.£1.136m makeover of Pontefract market complete

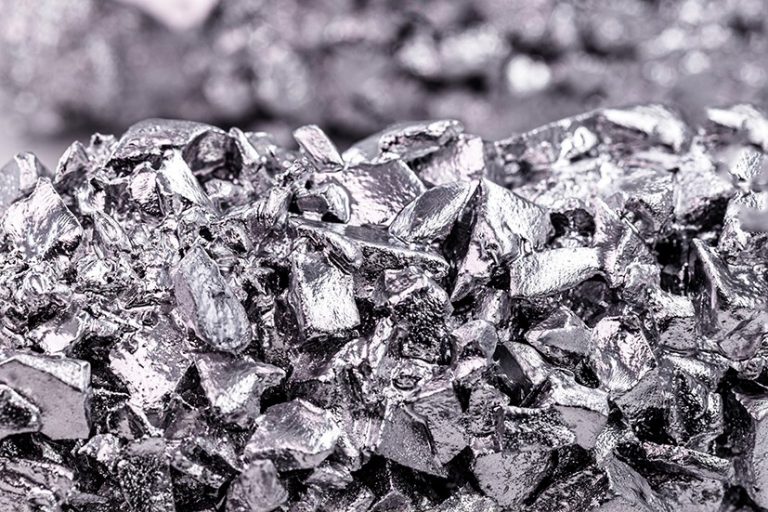

New ownership for metals and minerals supplier

2024 Business Predictions: Luke Gidney, Managing Director at HOP

Catterick’s multi-million pound re-development gets green light from planners

Council pushes back against erection of increasing numbers of broadband poles

UK economy shows growth but precarious position remains

British Steel turns to biomass experiment for sustainable fuel

A university research study supported by British Steel is investigating the production of an environmentally friendly green fuel.

The research will investigate whether the fuel, known as biochar, can replace injection coal in blast furnaces and act as a future clean carbon source for electric arc furnace steel production.

Peatlands are some of the most fertile lands in the UK for food growth, but decay of the peat soil emits large quantities of carbon dioxide. Alternatively, farming the land as sustainable wetlands, growing willow for biomass, prevents degradation of the peat.

Subjecting the willow crop to a thermochemical treatment called pyrolysis would be used to provide heat to enhance indoor farming productivity and produce biochar – a man-made charcoal. This biochar might then be used as a coal replacement, reducing the requirements for fossil fuels and reducing the net emissions that contribute to global warming.

Academics from the University of Lincoln have secured funding from the Industrial Decarbonisation Research and Innovation Centre for the project, and are working with farming estate and biochar supplier Lapwing Energy, CATCH – a champion for clean industrial growth – and British Steel.

As a partner in the project, the steelmaker is helping to steer the study and give a technical view on requirements to determine if biochar could replace injection coal and act as a future clean carbon source for electric arc furnace steel production.

Dr Andy Trowsdale, our Head of Research and Development, said: “By partnering with suitable suppliers, it is possible to provide sustainable feedstock materials and at the same time support land use projects that provide environmental benefits that far exceed those related to the fuel.

“A tonne of sustainable bio-carbon optimised for our steelmaking needs will reduce our net CO₂ emissions by three tonnes. But if the requirement for this material can prevent the degradation of peat re-wetting the land, then the CO₂ benefit can be nearly 10 times this amount. Combined with off-setting benefits from not extracting coal and each tonne of bio-carbon from this project has the potential to reduce UK net CO₂ emissions by nearly 30 tonnes.”

The project is funded by the UK Government as part of the Direct Air Capture and Greenhouse Gas Removal programme. The UK aims to reduce industrial emissions to net zero by 2050 and research projects that have received funding each support that ambition.

Building society highlights how to get extra income without working any harder…

Millions of people could be missing out on almost £1,000 extra income a year because their savings are in low- or no-interest paying current accounts, analysis from Yorkshire Building Society and CACI suggests.

There are nearly 13 million current accounts held in the UK with balances above £5001, and of those people who hold at least £5,001 in their current account, the average balance held is £24,500.

Almost £400bn is being held in current and savings accounts earning 1% interest or less, but people’s lack of understanding of the impact of their savings habits means millions are losing out on potentially thousands of pounds in interest.

Research also completed by Yorkshire Building Society suggests that over half of savers haven’t compared the interest paid on their accounts in the last year, and over a third hold most of their savings in a current account, offering little or no interest.

Chris Irwin, director of savings at Yorkshire Building Society, said: “Despite savings interest rates getting a lot of attention over the last year, following the significant increases in the Bank Rate, it’s surprising that there are still large pockets of people who are significantly missing out on savings interest – shopping around can now make a substantial difference to the returns available.

“Keeping large amounts of funds in low paying current accounts has become a costly mistake for millions. It’s understandable to want to have money accessible for emergencies or even topping up everyday expenses, but with so many instant access savings accounts currently available in the market paying a much higher return, there has never been a better time to review the home of your savings.

“Reviewing finances and savings can sometimes be an afterthought, with other things in life taking priority, however the start of a new year provides the perfect opportunity to take a close look at your finances and increase awareness of your situation and from there look at how you could make small changes which add up to much bigger returns.

“It doesn’t matter how you choose to go about it, but making just one positive change to your finances, could make a big difference in the long-term.”

Bradford bed firm secures Manufacturing Guild Mark for business excellence

Lincolnshire’s apprenticeship award scheme includes northern Lincolnshire in catchment area

For the first time ever Lincolnshire’s Apprenticeship Champion Awards will also accept applications from North and North East Lincolnshire.

- Greater Lincolnshire Apprentice Champion 2024

- Greater Lincolnshire Apprenticeship Employer Champion 2024

- Greater Lincolnshire Apprenticeship Training Provider Champion 2024