Wood Care Group acquires duo of Barnsley care homes

Leeds company swoops for international workplace management solutions firm

Motor giant accelerates into York warehouse

Motor giant, JCT600, has acquired a modern warehouse at Centurion Park on Clifton Moor in York.

JCT600, which has multiple dealerships, service, accident repair and van centres across Yorkshire, Humberside, Lincolnshire and the North East, purchased the 17,521 sq ft unit from leading parcel delivery company, DPD, for an undisclosed sum.

JCT600 is a well-known, family-run business with a 75-year pedigree. It is a trusted partner of 21 of the world’s best car brands, including Aston Martin, Porsche, Rolls Royce, Bentley, Ferrari and many more. The company will use the new site as a vehicle preparation centre.

Leeds property consultancy GV&Co advised DPD on the off-market transaction alongside sbh, and JCT600 was represented by Eaton Commercial.

Jonathan Jacob, senior surveyor from GV&Co, said: “Having let DPD their new state-of-the-art parcel facility on Northminster Business Park, we were delighted to have been retained to sell their building on Clifton Moor, which they had outgrown. Unit 1, Centurion Park provided a unique opportunity for JCT600 to acquire a modern, low site density building adjoining their existing ownership and we are pleased to have concluded the sale quickly.”

Robert Eaton, director at Eaton Commercial, added: “The opportunity for JCT600 to secure the freehold of further significant property in the heart of their dealership and support network at Clifton Moor, York, was not to be ignored, with the deal being rapidly concluded. JCT600 are now working up their plans for the business operation from the site.”

Three new faces prepare to step up at Yorkshire’s Chamber of Commerce

Government plans to fund replacement of unsafe cladding on thousands of buildings

“We will continue to work with DLUHC to ensure the pace we’re working at is maintained, so we can bring peace of mind and protection to the millions of people whose lives have been affected by unsafe cladding.”

Sheffield Forgemasters extends Harsco contract for five more years

Finance Yorkshire pumps £1m into Yorkshire music company

Work resumes on new energy-efficient houses after contractor’s collapse

£50m worth of investment in Rotherham to move a step closer

Around £50 million worth of investment in Rotherham will move a step closer when Rotherham Council’s Cabinet meets on Monday 7 August.

Lincoln property developer wins new contract in Nuneaton

Funding support for SMEs in East Riding of Yorkshire

Training firm fuelled by investment from private equity house

Lincolnshire’s JDM Food Group merges with US firm

Firms staring closure in the face consider dipping into personal savings to keep going

About a quarter of small business owners in the UK believe that they will be forced to cease trading if the outlook for their business does not improve, with almost 1.5m SME owners considering using personal savings to prop up their business.

The SME Insights Report, published by small business insurance provider Simply Business, found that 48% of SME owners believe the rising cost of living is the most glaring challenge facing their business, with a further 63% saying that rising taxes, interest rates, and inflation are eating into profit margins.

The findings, collated using the responses of more than 1,000 small business owners, shows that small businesses are caught between a rock and a hard place – being forced to increase their prices at a time when many consumers are cutting down spending. Nearly half of the UK’s SMEs say that they intend to raise prices by up to 10%, with a further one in three (36%) increasing prices by up to 20%. The UK’s cost-of-living crisis has compelled businesses to constantly be looking for ways to stay afloat.

SME owners also cited rising energy costs and a lack of government support as the key challenges they are facing. Over a quarter of SMEs are now spending up to 40% more on energy each month compared to the previous year, with some reporting a 150% increase in their monthly energy expenses.

Jonathan Portes, Senior Fellow of the Economic and Social Research Council and Professor of Economics and Public Policy at King’s College London, said: “Two themes emerge from this report. First, the extent of the continued pressures on SMEs from the wider economic environment. While the energy price spike has abated, and labour shortages have eased somewhat, more generalised inflationary pressures mean that SMEs are being squeezed from both ends, with some input costs rising and consumer demand impacted as real incomes have fallen. Recent rises in interest rates will exacerbate both.

“Second, and more optimistically, the resilience of the sector despite all this; the vast majority of SMEs remain positive about their own prospects, not just for survival but for growth, and most also expect the economy to improve.”

Despite the challenging economic landscape, there remains a glimmer of optimism among the small business community. Over half of the surveyed businesses (54%) expressed confidence in the UK economy’s potential for improvement within the current year. Additionally, an impressive 77 percent of respondents expressed confidence in their own business prospects for the next six months.

Alan Thomas, UK CEO at Simply Business, said: “The stoic spirit of small business owners is the backbone of the UK economy – their resilience is vital to the nation’s recovery and growth. The fact that many SMEs across the UK are struggling so significantly is a serious cause for concern for the British economy and communities.

Government to pump almost £9m into training providers for ‘insulation school’

- retrofit assessor and retrofit coordinator: provision and delivery of training to PAS 2035 standards

- insulation: provision and delivery of training to National Occupation Standards or higher in the installation of domestic insulation measures

“Our members look forward to collaborating with all those working to develop green skills and make this competition a success.”

Extra Government millions could boost York’s economy by 20 per cent

City of York Council has reached a deal with government which could generate as much as £40m in additional funding to maximise the impact and benefits of York Central, the revitalisation of th4 45-hectare site alongside the railway station.

City centre living project supported by Hull City Council Cabinet

Hull City Council given authority to progress devolution plans

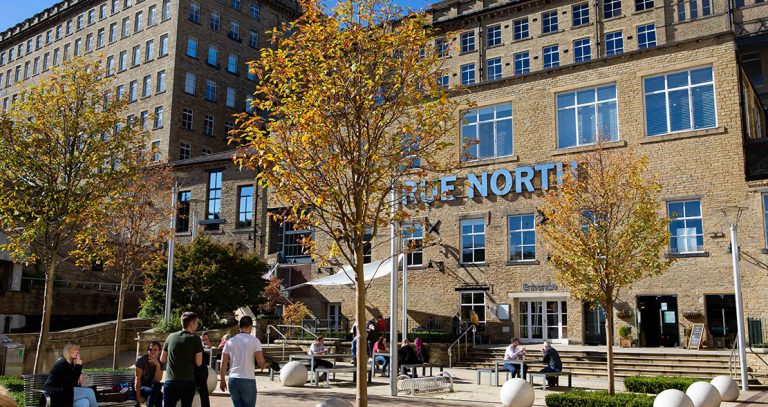

Dean Clough rides wave of interest with seven new independents moving in

Dean Clough in Halifax is to be the home of seven new independent operators together having taken almost 5,000 sq ft on the historic 22-acre site.

The former mill complex has been transformed as a place for work rest and play for about 3,000 people, and continues redevelopment to provide unique spaces.

K Jones Interiors has secured a new space within the recently renovated Bowling Mill Courtyard to provide residential and commercial interior design consultations. Session stylist Dawn Walsh has also taken space for a new hair salon, whilst beautician, Alina Balika has relocated her studio to be at Dean Clough.

Dot The Jewellers, which has been designing unique, custom jewellery for over 20 years has relocated to occupy one of the new retail units following recent redevelopment of the historic D Mill Courtyard.

Piece by Piece Physiotherapy has set up a clinic to offer expert help for back pain, osteoarthritis, sports injuries, concussions, and vertigo. This complements existing wellbeing services.

Northpark Pictures has also secured a lease for a new studio at Dean Clough. The multi award winning film production company produces video and content for brands including McDonalds, Virgin Atlantic, Enterprise and Oxo.

The Engine Room, a firm favourite café at Dean Clough for the last ten years, has secured a new lease on its 1,130 sq ft premises following new ownership.

Jeremy Hall, Chairman and MD at Dean Clough Ltd, said: “Independent businesses are the life blood of our high street, and we are always keen to offer flexible lease structures to support them. We warmly welcome them into the Dean Clough family which continues to provide choice, innovation, diversity, and authenticity for our audiences.

“We are progressing apace to expand the provision of high quality, Grade A workspaces for large and small businesses and we are unique in terms of the doorstep provision which includes considerable cultural experiences.”

Dean Clough is located on the edge of Halifax town centre, between Leeds and Manchester, and just 15 minutes from the M62 with direct train links to Leeds, Manchester, and London.