Josh earns promotion to Associate Director with Wright Vigar

Funds released to spur on technical developments in agriculture

“The success of the previous competition rounds and the broad scope of ideas coming forward showcase the range of possibilities available for driving up productivity and solving some of the industry’s biggest challenges. I encourage everyone to take a look at what’s on offer in the latest competitions and apply.”

Defra has published guidance for the third round of the Small R&D Partnerships competition, seeking to help businesses develop a new farming product or service and take it to commercialisation on the open market. Worth almost £10million, it has been developed in partnership with the Transforming Food Production Challenge and is delivered by Innovate UK. The second round of the competition has already funded projects including exploring how to breed sheep with a naturally low carbon footprint to help sheep farmers contribute to the journey towards net zero, and a project combining generation of electricity with growing berries to power operational processes such as automated picking, sensors and vehicles. It comes alongside new guidance for a £4.5million Feasibility Studies competition which aims to support businesses and researchers through the difficult testing phase of an idea, checking whether it works in practice and helping them assess whether to invest in a project. It looks for early-stage solutions that have the potential to substantially improve the overall productivity, sustainability and resilience of farming, and move existing agricultural sectors to net zero. Successful applicants in previous rounds include a study to identify fungal strains that can help fight against insect and fungal pests in wheat crops, reducing the costs associated with multiple applications of chemical pesticides, mechanical damage from repeated spray applications and crop yield losses. Farmers, growers, foresters, research organisations and businesses are encouraged to read the guidance ahead of applications opening. Applications for the Small R&D Partnerships competition open next week, and the Feasibility Studies competition window is open from 18 September. Dr Katrina Hayter, Executive Director for the Healthy Living and Agriculture Domain at Innovate UK, said: “We look forward to supporting the next round of applicants and identifying promising partnerships that hold the potential to address the sustainability, efficiency, and net zero challenges confronting the UK’s agrifood industry. “Feasibility studies mark the initial stage in researching an idea that could improve farming, while small R&D partnerships are a vital step to empowering businesses to forge novel farming products and services, paving the way towards successful commercialisation.“By fostering collaborations between farmers, growers, agri-businesses and researchers, these partnerships become the driving force behind transforming innovative solutions into practical applications.”

Sewell Group moves two consultancy businesses to Bridgehead Business Park

Sewell Group has invested in a new office building on Hessle’s Bridgehead Business Park as the business continues to expand.

The 9,500 square foot office, formerly occupied by Beal Homes, will house two of the company’s consultancy businesses, Shared Agenda and data intelligence firm Parallel. Previously based at offices in Willerby, the companies are experiencing a growth in local, regional and national clients and have outgrown their current space. The offices will also be used to provide extra hot desking space for the wider Sewell team. The location of the business park, with easy access to the motorway network, means the companies are well placed to serve their expanding client base across the north, and liaise easily with sister consultancy company Community Ventures, which has offices in Leeds, Stockton-on-Tees and Nottingham. Jo Barnes, MD of Sewell Estates, said: “Being a business that was established in East Yorkshire in 1876, it was important for us to keep our local roots as we expand. Professional services have been under-represented in the area for some time, so we are keen to invest further in developing talent within the region and attracting people from across the country. Whilst our Group will continue to have its headquarters on Leads Road in Hull, this new office base will help us to respond to our recent growth. “Our team are really excited about the move, as it will give them a better working environment, more space, and extra facilities to help make their working day run more smoothly. It’s important to ensure an attractive workspace that enables modern, collaborative working methods for our teams and our customers. As a part employee-owned business, we are investing in our future, as our ownership model enables us to take a much longer-term view than some other companies.” “Refurbishment of an already built facility, rather than reverting to a new-build, was also important for us as part of our journey to sustainability. Our construction team at Sewell Construction are skilled in transforming existing spaces and making them more sustainable. The upgrade of the building, with the installation of solar panels and more energy efficient systems, alongside a complete refurbishment designed by our team, brings together our in-house skills. I’m delighted with the emerging results and we expect to move into the property in September.” Bridgehead Business Park is a 612,000 square foot business development on the outskirts of Hull.Future of True North Brew Co secured, saving 325 jobs

Interest rates rise again

Stronger than expected first half for Belvoir Group

Streets Chartered Accountants covers tax topics, NICs, alcohol duty changes and Investment Zones in new news roundup

- if a UK VAT registration number is valid; and

- the name and address of the business the number is registered to…

‘Fairtrade Community’ status renewed in Hull

Rotherham set to agree £6.4m of funding to support economy

Ensuring that more residents benefit from a more inclusive local economy is at the heart of proposals set to be considered by Rotherham Council.

- Supporting Local Business

- People and Skills

- Communities and Place

BT Group’s flagship Sheffield office building reaches key milestone

R&D claims to come under greater scrutiny, as HMRC reveals £1 billion of ‘fraud and error’

Renewable energy projects to get more development cash from government

“Today’s increase will improve energy security and maximise the potential of the scheme. This will result in investment, a stronger renewables sector and growth to our economy.”

The increased funding combined with the introduction of annual auctions, will boost investments in Britain’s world-leading renewable industry, while strengthening the UK’s energy security, fostering growth in the country’s green industries and reducing exposure to volatile global gas prices. Energy Security Secretary Grant Shapps said the Russian invasion of Ukraine had made it plan that the UK had to do whatever was necessary to bolster the country’s energy security. Funding through our flagship Contracts for Difference scheme – the lifeblood of our renewables industry for nearly a decade – will help grow our economy by making Britain the first choice for investors in renewable energy projects and secure skilled jobs for future generations.“This will be the case for established technologies like solar, and new innovations like floating offshore wind and, alongside our backing for oil and gas, carbon capture and our revival in nuclear, will ensure we can help power more of Britain from Britain for decades to come.”

Today’s new funding for the current round (AR5) will mean:- An increased budget for established technologies such as solar and offshore wind – from £170 million to £190 million;

- An increase in the budget for emerging technologies such as floating offshore wind – up from £35 million to £37 million; and

- Maintaining £10 million ring-fenced budget for tidal stream projects

British Steel is at the heart of £35m railway station transformation

Hull property owners urged to keep it clean after £2,000 nuisance penalty

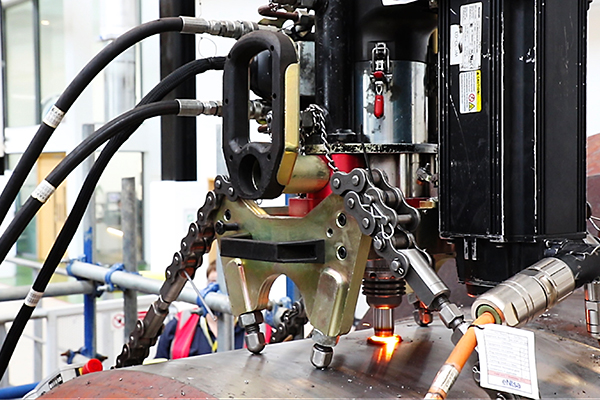

South Yorkshire specialists team up with South Africa and America to develop new weld repair technology

Communicating clearly: Plans could put £160m into high-tech satellite development

“This proposed record investment is also potentially a huge opportunity to harness our reputation as a world leader in innovation and R&D investment, supporting leading UK businesses to deliver the next generation of satellites and positioning the UK as true space superpower.”

To propel the UK’s capabilities and long-term ambitions in the space sector, the government is exploring grant funding of up to £100 million. The government is also exploring whether to support this grant funding with an additional £60 million from the European Space Agency’s (ESA) UK-backed Advanced Research in Telecommunications Systems (ARTES) programme, which supports UK industry in delivering commercial satellite communications infrastructure. The scheme would establish UK leadership in many critical areas for the next generation of LEO satellite communication technologies such as AI and machine learning.Carl lands regional trainer role with care provider

Carl Taylor from Cleethorpes has been appointed regional trainer for care home provider HICA.

He will provide learning and development to staff across a number of HICA’s care home and care services in Yorkshire and Lincolnshire including Grimsby Homecare, The Anchorage, Prospect House, The Birches, The Wolds, and Cranwell Court.

Carl will spearhead the delivery of comprehensive induction training to new recruits, ensuring they embrace the core values and ethos that have earned HICA Group its reputation for excellence in person-centred care. He will also provide requalification training to existing employees, enabling them to stay up to date with the latest industry standards and practices related to care delivery.

Steve Reed, learning and development manager at HICA Group, said: “Carl is an asset to our organisation and it’s great to have him on board. His expertise in care and education, coupled with his passion for person-centred care, will undoubtedly elevate the training standards across the Group and enhance the quality of our care provision.”

Carl brings extensive experience in the care and education sector, having worked for Kisimul Group which provides education and care for children and adults with autism, learning disabilities and complex needs. Carl has also served as a tutor at the Grimsby Institute, where he taught Level 3 Psychology. His academic background, which includes a BSc degree in Applied Psychology and a Post-Graduate Certificate in Education (PGCE).