Optimism among manufacturers fell slightly in July, after rising in April for the first time in nearly three years, according to the CBI’s latest quarterly Industrial Trends Survey.

Output volumes were broadly unchanged in the quarter to July, following a similar result in the three months to June, and under-performed expectations for modest growth. However, manufacturers continue to expect output to increase over the next three months, with growth expectations the strongest since March 2022.

Total new orders fell in the quarter to July but are expected to be broadly stable over the next three months. Inventory building is expected to provide some support to output in the months ahead. Stocks of work in progress are expected to rise at the fastest pace in over two years, with stocks of raw materials and finished goods also set to increase.

Average cost growth accelerated compared with April and remained elevated compared to historical norms. Cost growth is expected to slow in the quarter to October, while remaining historically strong. Domestic and export price inflation also accelerated but are both expected to slow in the next three months.

Meanwhile, manufacturers expect to raise their headcount in the next three months (and at the fastest pace for a year), and investment intentions for the year ahead have generally improved.

Ben Jones, CBI Lead Economist, said: “Sentiment among manufacturers has cooled a little over the past few months, as output growth consistently underperformed expectations. But the near-term outlook for the sector remains positive amid an ongoing recovery in the wider UK economy.

“Manufacturers appear confident that output growth will pick up in the quarter ahead, with expectations the strongest in over two years. Firms are looking to increase stock levels to meet expected demand. And the share of manufacturers working below capacity has fallen sharply over the last quarter, feeding through to a more positive outlook for both hiring and investment.

“Last week’s Kings Speech, with welcome measures to reform planning and speed up approvals for major infrastructure projects, has the potential to give businesses the confidence they need to grow, invest and drive economic growth. And as the economy picks up steam, firms will want to see a relentless focus on delivery from the new government, to turn proposed measures into swift and bold action.”

The survey, based on the responses of 257 manufacturing firms, found:

- Output volumes were broadly unchanged in the quarter to July (weighted balance of -3%, from +3% in the three months to June). Firms expect volumes to grow in the next three months (+25%), the strongest expectations since March 2022.

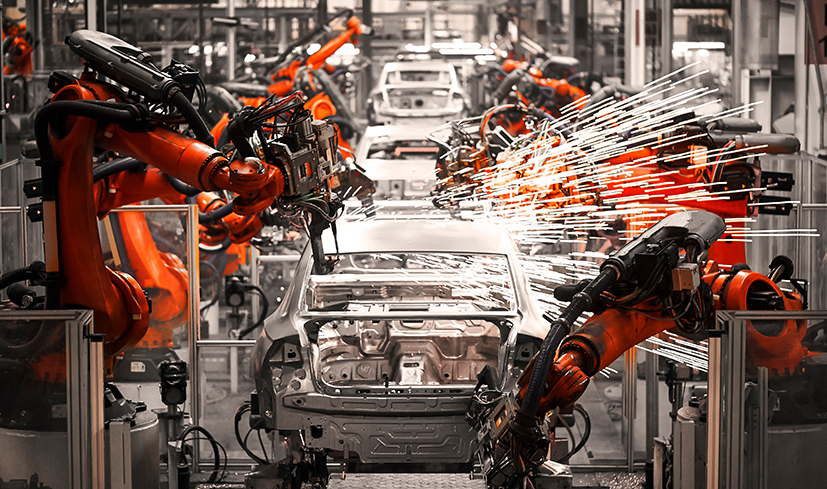

- Output rose in 6 out of 17 sub-sectors, with growth in the motor vehicles & transport equipment, chemicals, mechanical engineering and electrical goods sub-sectors offsetting declines in furniture & upholstery and metal manufacturing sub-sectors.

- Total new orders fell in July, at a similar pace to the previous quarter (balance of -9% from -6% in April). Domestic orders fell through the quarter (-15% from -6%), while the volume of new export orders was broadly unchanged (+3% from -14%). Manufacturers expect total new orders to be essentially unchanged over the next three months.

- Business sentiment fell in July, after rising in April for the first time in nearly three years (balance of -9% from +9% in April). Export optimism for the year was flat after rising last quarter (0% from +6%).

- Investment intentions for the year ahead generally strengthened compared with April. Manufacturers expect to raise investment in product & process innovation (a balance of +18% was the strongest since January 2022, up from +15% in April), in training & retraining (+7%, from +1%), and in plant & machinery (+6%, from +2%). Investment in buildings is set to fall (-11%, from -3%).

- The main constraint on investment was uncertainty about demand (cited by 44% of manufacturers), followed by inadequate net return (35%), a shortage of labour (20%), and a shortage of internal finance (19%). Concerns around the cost of finance have retreated from a 33-year high set in January (excluding the pandemic period) but remain double the long run average (10%).

- Average costs rose rapidly in the quarter to July (balance of +52%, from +39% in April; long-run average of +18%). Costs growth is expected to remain elevated in the quarter to October (+36%).

- Average domestic prices increased over the three months to July (balance of +15%, from +10% in April). Export price inflation also accelerated from April (+22% from +9%, and the fastest pace in over a year). Both domestic and export price growth are expected to slow in the next three months (+2% and +6%, respectively).

- Stocks of work in progress (balance of +4%) rose marginally in the quarter to July, while stocks of finished goods (+2%) and of raw materials (-1%) were broadly stable.

- Manufacturers expect stocks of work in progress (+13%) to rise at the fastest pace in over two years during the next three months, with stocks of raw materials (+7%) and of finished goods (+5%) also set to increase.

- Numbers employed were unchanged in the quarter to July, after falling in April (balance of 0% from -6%). Firms expect numbers employed to rise modestly in the next three months (+16%).