Manufacturers reported that output volumes fell in the three months to March, and at a similar pace to the three months to February, according to the CBI’s latest Industrial Trends Survey (ITS). However, manufacturers expect output to rise modestly in the quarter to June.

Expectations for future selling price inflation edged up for the third successive month in March, with the balance rising further above its long-run average to its highest since May 2023. Total order books were steady compared with last month, and a little below their long-run average, but export order books deteriorated.

The survey, based on the responses of 289 manufacturers, found:

- Output volumes fell in the three months to March, at a similar pace to the quarter to February (weighted balance of -18%, from -19% in the three months to February), and disappointing expectations for marginal growth (+4%). Output is expected to rise modestly in the three months to June (+8%).

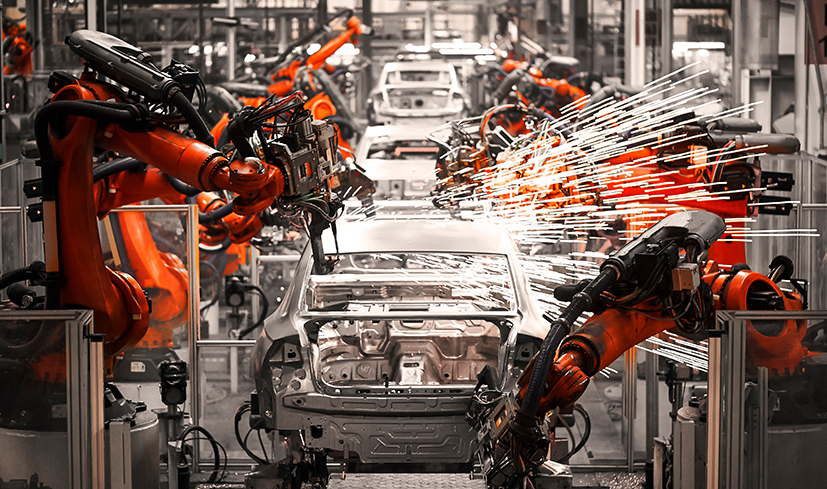

- Output fell in 11 out of 17 sub-sectors in the three months to March, including the chemicals, motor vehicles & transport equipment, plastic products and metal products sub-sectors.

- Total order books were reported as below “normal” in March and were broadly unchanged relative to last month (-18% from -20%) at a level slightly below the long-run average (-13%).

- Export order books were also seen as below normal and deteriorated relative to last month (-29% from -14%) to below the long-run average (-18%).

- Expectations for average selling price inflation accelerated in March (+21%, from +17% in February)—comfortably above the long-run average (+7%) and to the greatest extent since May 2023.

- Stocks of finished goods were seen as more than “adequate” in March (+12% from +11% in February), with stock adequacy broadly unchanged since the previous month (+12% from +11% in February), in line with the long-run average.

Anna Leach, CBI Deputy Chief Economist, said: “It’s disappointing that manufacturing output volumes fell in the first three months of the year, underperforming last month’s expectations for a slight upturn. But manufacturers remain optimistic that conditions will improve in the quarter ahead.

“Manufacturers expect selling prices to rise a little in the months ahead. With demand still subdued, this likely reflects some pressure on input costs over recent months, slightly higher oil prices, higher shipping costs amid the Red Sea disruption, and signs that the global industrial cycle is beginning to turn upwards after a difficult couple of years.

“In a general election year, all parties must focus on fostering a business environment that will give UK manufacturers the confidence they need to invest and compete globally. The Chancellor’s announcement of plans to extend full capital expensing to leased and rented assets was a welcome step that will help smaller and medium-sized manufacturers in particular, but more clarity over its implementation would be welcomed.”